Insurance software development isn’t a trend. It’s the infrastructure that keeps modern insurers running. And in 2026, there’s zero room for slow, brittle, legacy systems. Customers expect instant quotes, real-time claims updates, and seamless digital journeys. Regulators expect airtight compliance. And your competitors? They’re already modernizing.

Building insurance software today isn’t about “going digital.” That ship sailed years ago. It’s about creating systems that actually work at scale, handling complex policies, automating claims, integrating with third-party data, and evolving as regulations and customer expectations change.

This guide focuses on what actually matters, how insurance software is built today, what successful teams prioritize, and where most projects fail. If you’re modernizing, rebuilding, or launching insurance software in 2026, this is the practical overview you need.

What Is Insurance Software Development?

Insurance software development is the process of building systems that run an insurance business, including policy management, claims processing, underwriting, billing, customer portals, and analytics. These tools automate manual work, reduce risk and errors, and make it possible to serve customers at scale.

In 2026, this software isn’t optional. Customers expect to buy policies online, file claims in minutes, and get real-time updates. Regulators expect secure, auditable systems. And insurers that rely on slow or fragmented platforms simply fall behind.

Modern insurance software development includes custom-built platforms, API integrations with third-party data providers, and seamless connections to existing internal systems. It’s where engineering discipline meets deep insurance domain knowledge built for speed, security, and long-term adaptability.

Why Insurance Companies Need Custom Software in 2026

Off-the-shelf insurance platforms are built for averages. That works until you need to launch a new product, adapt to new regulations, or change how your business actually operates. At that point, generic tools become a bottleneck.

Custom insurance software is built around your workflows, not someone else’s roadmap. It lets you automate what makes your business unique, design customer experiences that match your brand, and integrate exactly the data sources and services you rely on. You move faster because you control the product.

In 2026, customers expect to buy, manage, and claim insurance entirely online, often in minutes, from a phone. If your systems can’t support that, customers don’t wait. They switch. Custom software isn’t just an efficiency upgrade anymore. It’s how insurers stay competitive.

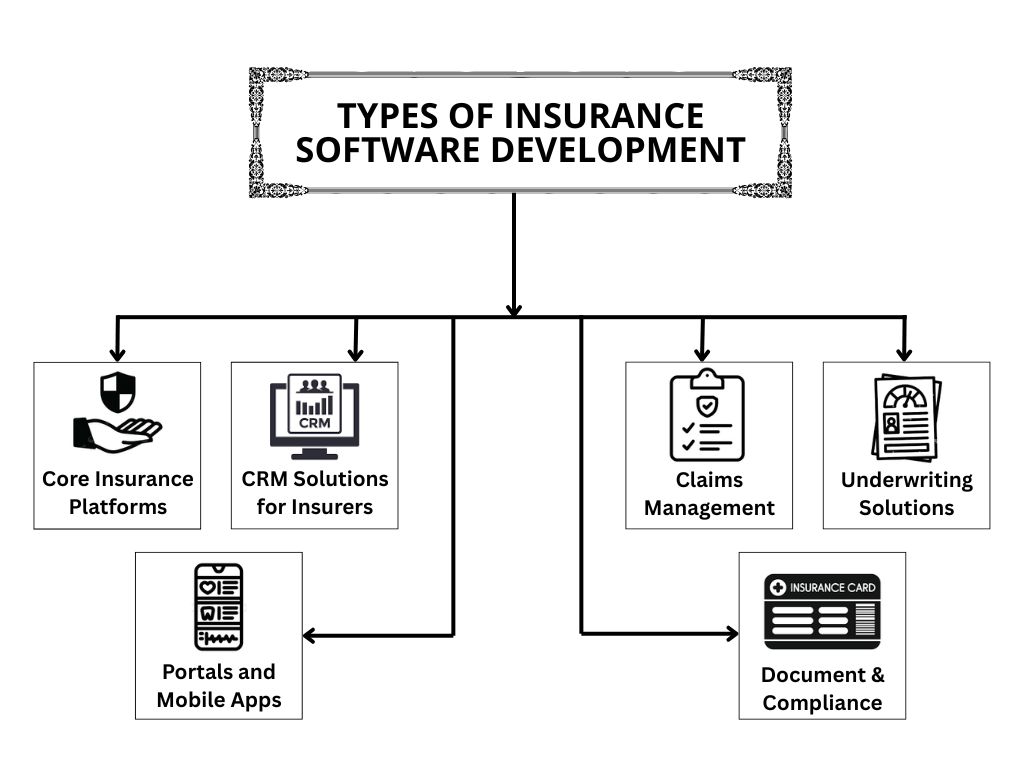

Types of Insurance Software in 2026

Insurance technology in 2026 is built around flexibility, integration, and long-term scalability. Each type of software plays a critical role in supporting operations, improving customer experience, and meeting regulatory demands in a digital-first insurance landscape.

Core Insurance Platforms

Core insurance platforms run the business. They manage policies, billing, claims, and product configuration in a single system. Modern platforms are cloud-native, API-driven, and modular, allowing insurers to launch new products, enter new markets, and scale without replacing their core systems.

CRM Solutions for Insurers

Insurance-focused CRM systems centralize customer data across sales, service, and claims. They enable personalized communication, automate renewals and follow-ups, and provide a complete view of each policyholder. This helps insurers improve retention while reducing manual customer management.

Claims Management Systems

Claims management software handles the entire claims lifecycle, from first notice of loss to settlement and payout. Automation reduces processing time, while built-in rules and fraud detection limit risk. Transparent status updates improve trust and customer satisfaction.

Underwriting Solutions

Underwriting software supports risk evaluation and pricing decisions using data, analytics, and AI models. It analyzes internal records and third-party data sources to improve accuracy. Faster underwriting leads to better customer experiences and stronger profitability.

Insurance Portals and Mobile Apps

Customer portals and mobile apps serve as the primary digital touchpoints for policyholders. They offer self-service access to policies, payments, claims, and documents. In 2026, mobile-first, intuitive design is essential, not optional.

Document & Compliance Tools

Document management and compliance software digitize insurance records and streamline audits. They automate regulatory reporting, enforce data privacy rules, and track compliance changes. This reduces operational risk and lowers the cost of staying compliant.

Core Features of Modern Insurance Software (2026)

Modern insurance software in 2026 is built to be fast, flexible, and customer-first. These core features aren’t “nice to have”; they’re the minimum required to run efficiently, stay compliant, and compete in a digital-only insurance market.

- Policy Management: Real-time policy creation, updates, and self-service tools that reduce support load and speed up issuance.

- Claims Processing: Online claim submission, document uploads, status tracking, and automated fraud checks to accelerate payouts.

- Customer Portals: Secure, mobile-first access to policies, payments, and claims available 24/7.

- Billing & Payments: Automated billing, multiple payment options, digital wallets, and smart reminders to reduce delays.

- Risk & Underwriting: AI-driven risk analysis that improves pricing accuracy and protects margins.

- Regulatory Compliance: Built-in compliance controls, audit trails, and fast adaptation to regulatory changes.

- Analytics & Reporting: Real-time dashboards and automated reports that turn data into clear business insights.

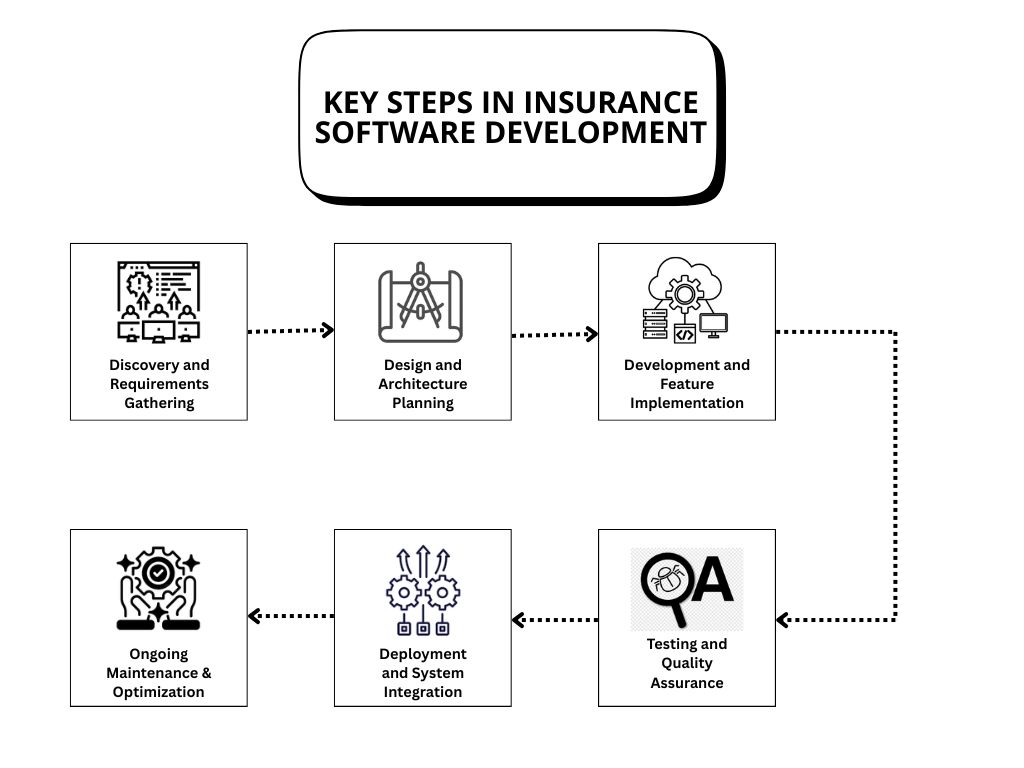

Key Steps in Insurance Software Development

Modern insurance software in 2026 is built through a structured, business-first process. These steps reflect how successful insurers reduce risk, meet regulatory demands, and deliver systems that scale without constant rework.

Step 1: Discovery and Requirements Gathering

Discovery sets the direction for everything that follows. Teams analyze existing systems, insurance workflows, regulatory constraints, and user roles in detail. Business goals are translated into technical requirements, risks are identified early, and success metrics are defined. Strong discovery prevents scope creep, rework, and compliance gaps later.

Step 2: System Design and Architecture Planning

Here, developers plan how the software will work. They choose the tech stack, design the architecture, and create wireframes or mockups. Good design ensures scalability and makes future updates easier.

Step 3: Development and Feature Implementation

Development focuses on building high-impact features first. Teams use agile methods to release in short cycles, validate functionality, and adapt quickly. Core insurance logic, automation rules, and third-party integrations are developed together to ensure the system delivers measurable operational value.

Step 4: Testing and Quality Assurance

Testing ensures the software performs reliably at scale. Automated tests validate functionality, security, and performance, while manual and user acceptance testing confirm real-world usability. Compliance, data privacy, and edge cases are thoroughly reviewed before production deployment.

Step 5: Deployment and System Integration

Deployment is treated as a controlled transition, not a single event. Data migration, system integrations, and environment configuration are carefully executed. Monitoring, backup, and rollback strategies ensure business continuity and minimize operational disruption.

Step 6: Ongoing Maintenance and Optimization

Post-launch, the platform must continuously evolve. Teams address bugs, performance bottlenecks, regulatory changes, and new feature demands. Ongoing optimization keeps the software secure, efficient, and aligned with business growth over time.

Insurance Software Development Trends for 2026

Insurance software trends in 2026 are shaped by one clear goal: faster decisions, lower risk, and better digital experiences. These aren’t experiments anymore; they’re becoming standard expectations across the insurance industry.

- AI & Machine Learning: Power fraud detection, claims automation, underwriting models, and customer support with higher accuracy and lower manual effort.

- Cloud-Native Platforms: Enable rapid scaling, faster releases, and lower infrastructure overhead without sacrificing reliability.

- Insurtech Integrations: Connect telematics, IoT, and health data to build smarter products and more precise pricing.

- API-First Development: Make integrations easier, partnerships faster, and innovation continuous.

- Cybersecurity by Design: Embed encryption, identity controls, and real-time monitoring from day one.

- Personalized Experiences: Use data to tailor pricing, offers, and communication across the customer journey.

- Embedded Insurance: Deliver coverage directly at checkout through APIs and partner platforms.

How Much Does Insurance Software Development Cost in 2026?

There’s no single price tag for insurance software. Cost depends on scope, compliance requirements, integrations, and how future-proof the platform needs to be. Even “simple” insurance systems require security, scalability, and regulatory readiness so budgets have moved up in 2026.

Typical 2026 cost ranges look like this:

- Basic policy or claims system: $80,000–$180,000 (Covers core workflows, limited integrations, and standard security)

- Full-featured insurance platform: $200,000–$600,000 (Includes policy, claims, billing, customer portals, and third-party integrations.)

- Enterprise-grade platform with AI: $600,000–$1.5M+ (Built for scale, advanced analytics, AI-driven underwriting or fraud detection, and deep system integrations.)

Ongoing costs matter just as much. Expect 15–25% of the initial build per year for maintenance, cloud infrastructure, security updates, and regulatory changes. Done right, the return comes from automation, lower operational costs, faster launches, and better customer retention, not just software ownership.

Choosing an Insurance Software Development Partner in 2026

Selecting the right development partner is a strategic decision. In 2026, insurers need teams that can deliver secure, scalable systems and support them long after launch.

Industry Experience

Insurance software has unique workflows, data models, and regulatory demands. A partner with real insurance experience understands policy lifecycles, claims complexity, and compliance requirements. This reduces learning curves, avoids costly errors, and ensures the software fits real operational needs from day one.

Technical Expertise

Your partner must be strong in cloud-native development, API-first architecture, security, and data-driven features like AI. What matters most is proven execution delivering similar systems that scale, integrate smoothly, and perform reliably under real-world conditions.

Project Management & Delivery

Clear structure keeps projects on track. Agile delivery, defined milestones, frequent demos, and transparent communication help avoid delays and misalignment. The best partners manage risk proactively and adapt quickly as requirements evolve.

Security & Compliance Readiness

Security is foundational in insurance software. A reliable partner embeds encryption, access controls, audit logs, and compliance checks throughout development. They should understand regulatory standards and design systems that are secure by default, not patched later.

Post-Launch Support & Ownership

Software requires continuous care. Strong partners offer long-term support, performance optimization, and regulatory updates. Ongoing ownership ensures the platform stays stable, compliant, and aligned with business growth over time.

Best Practices for Building Insurance Software in 2026

In 2026, great insurance software is defined by simplicity, security, and scalability, not feature overload. These best practices highlight what actually works when building systems meant to last.

Start with Real User Needs

Every strong insurance platform starts with real-world insight. Speak directly with agents, claims handlers, underwriters, and customers to understand daily pain points. Design features around actual workflows, not assumptions. Solving real problems first leads to faster adoption and measurable operational gains.

Design for Scalability

Insurance businesses evolve constantly. Your software must support growth in users, policies, and data without performance issues. Modular, cloud-native architecture allows teams to add features, enter new markets, and respond to regulatory changes without rebuilding the core system.

Build Security into the Foundation

Security cannot be an afterthought in insurance software. Sensitive customer and financial data require encryption, role-based access, audit trails, and continuous monitoring. Building security into the foundation reduces breach risk and simplifies regulatory compliance over time.

Automate High-Impact Workflows

Automation should target processes that are repetitive, time-consuming, and rule-driven. Claims intake, document processing, underwriting checks, and renewals are ideal candidates. Smart automation reduces manual errors, lowers operational costs, and speeds up service delivery.

Test Early and Often

Testing should happen throughout development, not just before launch. Automated testing ensures stability with every update, while user testing validates real-world usability. Early testing prevents costly fixes and protects customer trust.

Keep the Experience Simple

Insurance products are complex by nature, but software should hide that complexity. Clean interfaces, clear language, and guided steps help users complete tasks quickly. A simple experience improves satisfaction, reduces support requests, and drives long-term engagement.

Common Pitfalls in Insurance Software Projects

Insurance software projects fail for predictable reasons. In 2026, avoiding these mistakes is less about luck and more about discipline, planning, and execution.

- Scope Creep: Uncontrolled feature additions stretch timelines and budgets. Lock core goals early and push non-essential features to later releases.

- Regulatory Blind Spots: Insurance regulations change fast. Systems must be flexible, with compliance reviewed continuously, not after launch.

- Weak Data Migration: Poorly planned data moves cause delays and errors. Test migrations early using real data and validated mappings.

- Ignoring User Training: Adoption suffers without proper onboarding. Invest in training, documentation, and ongoing support.

- Mobile as an Afterthought: Customers expect full mobile access. Design and test mobile-first, not as a secondary experience.

Case Example: Modernizing Claims Processing in 2026

Consider a mid-sized insurer struggling with slow, manual claims handling. Paper forms, phone follow-ups, and disconnected systems were dragging processing times and frustrating customers. The objective was clear: replace friction with speed and visibility.

The solution was a cloud-based web and mobile claims platform. Customers could submit claims digitally, upload documents, and track progress in real time. On the backend, automated document extraction, rule-based workflows, and AI-driven fraud signals reduced manual review without compromising accuracy.

Early testing exposed usability gaps on mobile devices, which were fixed before full rollout. Post-launch, average claims processing time dropped by 40%, customer satisfaction improved significantly, and operational costs fell. More importantly, the insurer gained a flexible system that could adapt quickly to new regulations and volume spikes, something the legacy setup never allowed.

From Legacy Systems to Future-Ready Insurance Software

Insurance software in 2026 isn’t about “digital transformation” anymore; that debate is over. The winners are building systems that scale cleanly, adapt to regulation without friction, and make insurance easier for both customers and internal teams.

The path is clear: define the business outcome first, invest in flexible architecture, automate what slows you down, and design every workflow around real users. Do that consistently, and the software stops being a cost center; it becomes a competitive advantage.

Insurance has gone digital for good. What matters now is whether your software can keep up with changing customers, regulations, and growth.