In 2026, banks are under pressure from every direction: stricter regulations, customers who expect app-level experiences, and fintechs that ship features in weeks, not years. Security and stability are table stakes now. What actually matters is whether your software helps the bank move faster without breaking compliance or trust.

So what does modern banking software really look like today? And more importantly, how do you build systems that don’t just survive audits, but win customers?

This guide breaks it down in plain English. You’ll learn how banking software is built in 2026, which features are no longer optional, and which trends are worth your attention (and which are noise). Whether you’re leading IT at a traditional bank or building the next fintech product, this is a practical, no-BS overview of what actually works.

What Is Banking Software Development?

Banking software development is the process of designing, building, testing, and maintaining digital systems used by banks and financial institutions. This includes core banking platforms, mobile and web apps, payment systems, compliance tools, and internal operational software.

The goal is simple: help banks move money safely, serve customers faster, manage risk, and stay compliant without slowing the business down. In 2026, that means software that’s secure by default, easy to use, and flexible enough to evolve with regulations and customer expectations.

Modern banking software does a lot of heavy lifting. It manages accounts and transactions, powers digital payments and lending, enforces security controls, runs real-time analytics, and integrates with fintechs, regulators, and third-party services. It’s a tightly connected ecosystem, and if one part breaks, everything feels it.

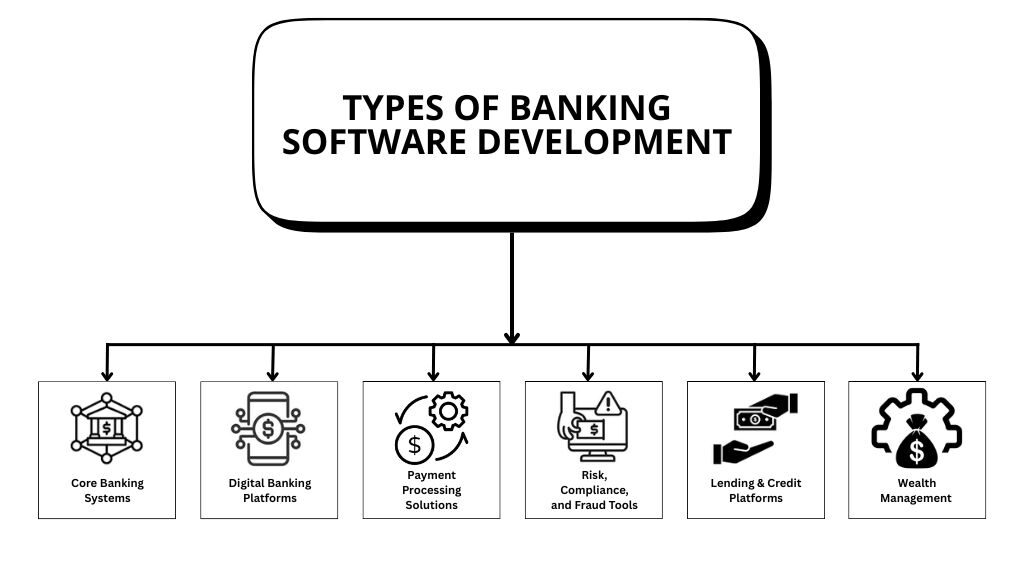

Types of Banking Software in 2026

Banking software isn’t one-size-fits-all. In 2026, modern banks run on multiple systems, each designed for a distinct purpose, and all must operate in sync.

Core Banking Systems

Core banking systems run the bank’s day-to-day operations. They manage customer accounts, transactions, interest calculations, and regulatory reporting. In 2026, these platforms are cloud-native, API-driven, and built for real-time processing. Downtime isn’t acceptable, and scalability is critical as banks expand digital services and integrate with fintech partners.

Digital Banking Platforms

Digital banking platforms power mobile apps and online portals that customers interact with daily. They handle balances, transfers, bill payments, onboarding, and support. In 2026, customers expect instant updates, biometric authentication, and frictionless experiences. Banks compete less on features and more on speed, reliability, and ease of use.

Payment Processing Solutions

Payment processing software enables card payments, real-time transfers, cross-border transactions, and digital wallets. Speed, accuracy, and security are non-negotiable. In 2026, support for contactless payments, instant settlement, and multiple payment rails is standard, while strong fraud prevention runs quietly in the background.

Risk, Compliance, and Fraud Tools

These tools help banks meet regulatory requirements and prevent financial crime. They support AML, KYC, transaction monitoring, and fraud detection. In 2026, AI and machine learning analyze behavior in real time, reducing false positives while keeping institutions compliant and audit-ready.

Lending and Credit Platforms

Lending platforms automate loan origination, underwriting, disbursement, and servicing. They integrate with credit bureaus, open banking APIs, and alternative data sources. In 2026, the focus is on faster approvals, smarter risk assessment, and seamless digital journeys for both retail and business borrowers.

Wealth Management and Analytics Tools

These platforms support investments, portfolio management, advisory services, and internal analytics. In 2026, AI-driven insights help banks personalize advice and optimize portfolios. Tight integration with core systems ensures accurate data, better reporting, and more informed decision-making across the organization.

Must-Have Features of Modern Banking Software (2026)

Modern banking software isn’t judged by how many features it has, but by how well it performs under pressure. Customers expect speed and simplicity, regulators expect precision, and security teams expect zero blind spots. These are the features that actually matter in 2026:

- Mobile-first experience: Designed for smartphones with fast load times, biometric authentication, real-time alerts, and frictionless navigation.

- Enterprise-grade security: Multi-factor authentication, end-to-end encryption, behavioral monitoring, and proactive threat detection built in.

- API-first architecture: Open, well-documented APIs that simplify integrations and support open banking requirements.

- Real-time processing: Instant transaction updates, payments, and notifications with no lag.

- AI-driven personalization: Smart insights, relevant offers, and fraud detection without crossing privacy lines.

- Automated compliance: Built-in KYC, AML, and regulatory reporting to reduce manual effort and audit risk.

- Scalable by design: Infrastructure that handles growth, traffic spikes, and regulatory changes without major rewrites.

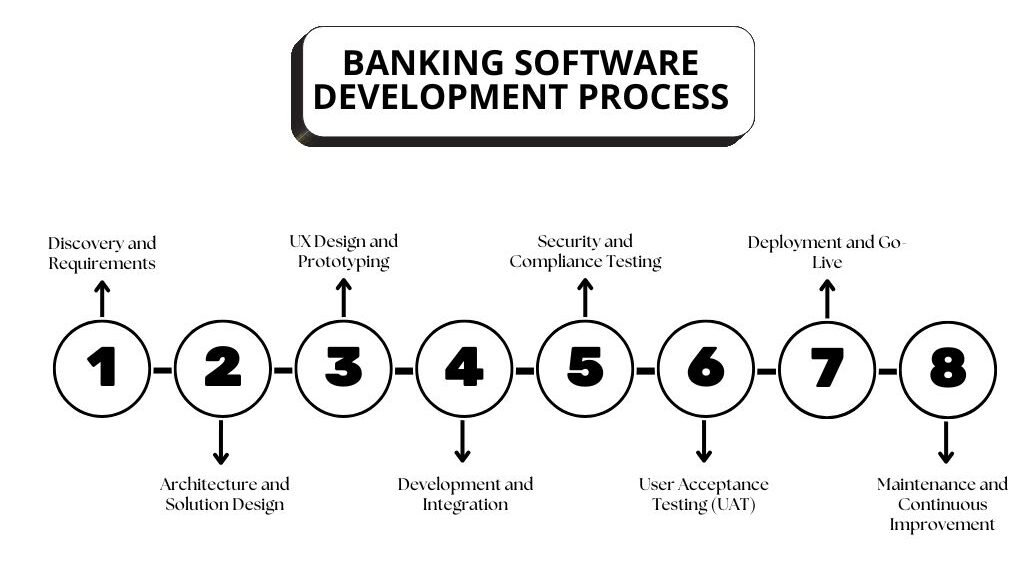

Banking Software Development Process: Step by Step

Building banking software isn’t about moving fast; it’s about moving right. In 2026, successful teams focus on reducing risk early, validating assumptions often, and designing systems that can evolve without breaking compliance or customer trust.

Step 1: Discovery and Requirements

This phase defines what you’re actually building and why. Teams align business goals, customer needs, and regulatory constraints through workshops, interviews, and system audits. In 2026, discovery also includes data strategy, security expectations, and compliance mapping. Clear requirements here prevent scope creep, rework, and costly delays later.

Step 2: Architecture and Solution Design

Here, teams design the technical backbone. This includes system architecture, cloud strategy, data flows, and integration points. In 2026, API-first, cloud-native, and modular architectures dominate because they scale better and adapt faster to regulatory or business changes.

Step 3: UX Design and Prototyping

Design teams create wireframes and interactive prototypes to validate workflows early. The focus is usability, accessibility, and speed. In 2026, banks test designs with real users before development begins, reducing friction and ensuring the final product feels intuitive from day one.

Step 4: Development and Integration

This is where features are built and systems connected. Teams use agile sprints, automated testing, and continuous integration to ship safely and often. Secure APIs handle integrations with payment providers, fintechs, and internal systems, keeping development flexible and controlled.

Step 5: Security and Compliance Testing

Before release, the software is stress-tested against real-world threats. This includes penetration testing, vulnerability scanning, and compliance validation. In 2026, security is continuous, not a one-time checkpoint, with automated controls baked into the development pipeline.

Step 6: User Acceptance Testing (UAT)

User Acceptance Testing validates the software in real-world scenarios before launch. Bank staff, compliance teams, and selected customers test core workflows in a controlled environment. In 2026, UAT goes beyond basic functionality, focusing on performance under load, usability across devices, edge cases, and regulatory workflows. This step helps catch issues that automated tests can’t.

Step 7: Deployment and Go-Live

Deployment is no longer a “big bang” release. In 2026, banks use staged rollouts, feature flags, and cloud-based deployments to minimize risk. Real-time monitoring tracks system health, transaction success rates, and security events. Support and incident-response teams stay on standby to address issues quickly during early production use.

Step 8: Maintenance and Continuous Improvement

After launch, the real work begins. Banking software requires constant updates to stay secure, compliant, and competitive. Teams release security patches, optimize performance, and add new features based on customer feedback and regulatory changes. In 2026, continuous improvement is driven by data, not guesswork.

Top Trends Redefining Banking Software Development in 2026

Banking software trends now focus on speed, resilience, and compliance at scale. What matters isn’t hype, but what actually works in production, especially in 2026.

- AI as infrastructure: Machine learning now powers fraud detection, credit decisions, risk scoring, and customer support quietly, continuously, and at scale.

- Cloud-native by default: Core systems are built or modernized for the cloud, with hybrid setups supporting legacy workloads. Speed and resilience drive adoption.

- Embedded finance and open banking: Banking services live inside non-banking apps, enabled by secure, well-governed APIs.

- Hyper-personalization: Real-time data fuels personalized insights, offers, and experiences across every channel.

- Zero trust security: Every user, device, and request is verified, no assumptions, no shortcuts.

- Low-code acceleration: Teams ship internal tools and workflows faster without compromising governance.

- RegTech automation: Compliance, monitoring, and reporting are increasingly automated to keep pace with regulation.

Challenges in Banking Software Development

Modern banking software is built under constant pressure from regulators, attackers, and impatient users. These challenges don’t slow down in 2026; they compound:

- Legacy systems and technical debt: Aging core platforms slow innovation, complicate integrations, and increase operational risk.

- Relentless security threats: Banks face constant attacks from phishing to ransomware, requiring continuous monitoring and skilled security teams.

- Regulatory complexity: Rules change often and vary by region, making compliance an ongoing engineering challenge.

- Talent shortages: Experienced engineers with banking, cloud, and security expertise are hard to find and harder to retain.

- Third-party integration risk: Connecting fintechs, payment rails, and regulators adds dependencies and failure points.

- Rising UX expectations: Customers expect fast, intuitive apps and switch providers quickly when experiences fall short.

How to Choose a Banking Software Development Partner

Choosing the right partner is less about cost and more about risk reduction. Banks need teams that understand regulation, security, and long-term delivery, not just code. Here’s what to look for in 2026:

Relevant Experience

A capable partner has real experience building banking or fintech systems, not just generic software. They understand core banking platforms, payment flows, audits, and regulatory constraints. This experience reduces onboarding time, avoids common mistakes, and helps projects move faster with fewer compliance-related surprises.

Security and Compliance Expertise

Security must be built in, not bolted on. Your partner should follow secure-by-design principles, understand banking regulations, and have experience with standards like PCI DSS, ISO 27001, or SOC audits. Ask how they handle data protection, access controls, and security testing throughout development.

Agile and Transparent Delivery

Banking requirements change frequently. Agile partners work in short sprints, share progress often, and adapt without losing control. Regular demos, clear documentation, and open communication ensure you always know what’s being built, what’s delayed, and what risks need attention.

Testing and Quality Assurance

Banking software can’t afford production failures. Strong partners invest in automated testing, manual validation, and continuous quality checks. This includes functional, performance, and security testing to catch issues early and ensure reliability under real-world transaction volumes.

Ongoing Support and Maintenance

Launching the software is only the beginning. Banks need long-term support for updates, performance tuning, security patches, and regulatory changes. A reliable partner offers structured post-launch support and clear processes for incident response and continuous improvement.

Proven Results and References

Case studies and client references show how a partner performs under real banking constraints. Look for examples involving regulated environments, complex integrations, and long-term delivery. Past success with banks or financial institutions is the strongest indicator that they can deliver again.

Cost of Banking Software Development in 2026

Banking software doesn’t have a fixed price tag. In 2026, costs depend on complexity, security depth, compliance scope, and integrations more than the feature list alone.

Here’s a quick breakdown of common cost factors:

- Core banking systems: $1.5M–$7M+ (Full-scale platforms with transaction processing, compliance, and integrations)

- Mobile banking apps: $200K–$1M (Based on platform coverage, UX quality, security layers, and real-time features)

- Payment processing solutions: $150K–$600K (Covers cards, instant payments, fraud prevention, and external integrations)

- Custom modules (KYC, AML, analytics): $75K–$350K per module (Pricing varies by automation level, AI usage, and regulatory requirements)

Ongoing costs remain critical. Plan for 15–25% of the initial build annually for maintenance, security patches, compliance updates, cloud hosting, and API fees.

Best Practices for Successful Banking Software Projects

Banking software succeeds or fails long before launch. The difference comes down to discipline: clear decisions early, security everywhere, and continuous validation in 2026:

Start with Clear Requirements

Clear requirements reduce risk before a single line of code is written. Define business objectives, user roles, compliance obligations, and success metrics upfront. In 2026, strong teams also document assumptions and constraints early, making future changes deliberate rather than reactive.

Involve Stakeholders Early

Banking software impacts many functions. Involving business leaders, IT, compliance, security, and end users from the start helps surface risks early. This alignment prevents late-stage surprises, accelerates approvals, and ensures the final product meets real operational needs.

Prioritize Security from Day One

Security must be embedded into architecture, development, and testing. In 2026, this includes secure-by-design principles, continuous security testing, and real-time monitoring. Treating security as a foundation, not a feature, reduces breaches, audit issues, and downtime.

Embrace Agile Delivery

Agile delivery breaks large projects into smaller, manageable releases. Regular iterations allow teams to respond quickly to feedback, regulatory updates, and technical issues. In 2026, this approach reduces deployment risk while keeping momentum and transparency high.

Invest in Training and Documentation

Even powerful software fails without adoption. Clear documentation and structured training help staff and customers use the system correctly. In 2026, good onboarding reduces operational errors, lowers support costs, and increases confidence in new digital tools.

Monitor and Improve Continuously

Launch is only the beginning. Track system performance, security events, and user behavior in real time. In 2026, data-driven insights guide improvements, prioritize fixes, and keep banking software secure, compliant, and competitive.

The Future of Banking Software Development

Banking software in 2026 isn’t about chasing trends; it’s about building systems that hold up under scrutiny. Security, scalability, and usability are no longer competitive advantages; they’re the minimum cost of entry. What separates leaders from laggards is how fast they adapt without compromising trust or compliance.

Whether you’re modernizing legacy infrastructure or launching a new digital product, success comes from disciplined execution: clear requirements, incremental delivery, and constant feedback. Security and compliance aren’t checkpoints; they’re part of every decision.

Get the fundamentals right, choose the right partners, and build with intent. That’s how banking software moves from “working” to actually winning.