Let’s be real—most SaaS founders love dashboards…until they realize half the numbers on them don’t actually matter.

You can have 47 charts, 128 metrics, and a weekly “data sync” meeting, but if you’re tracking the wrong stuff, you’re just decorating your grave.

The truth? Growth doesn’t come from staring at vanity metrics. It comes from obsessing over the few numbers that actually drive revenue, retention, and runway.

In this post, I’ll cut the fluff and dive into the 12 SaaS KPIs that separate companies scaling to $10M ARR from the ones slowly fading into the churn abyss.

What Are SaaS KPIs?

SaaS KPIs are like the scoreboard for your SaaS business. They don’t tell you how to win—but they make it painfully obvious if you’re losing.

In simple terms, SaaS KPIs are the handful of numbers that show whether your business is actually working. They measure the health of your growth, revenue, retention, and efficiency.

The best part? When you track the right ones, they don’t just tell you what happened. They tell you what to do next.

The worst part? Most founders still get this wrong. They obsess over vanity metrics that look impressive in investor decks but mean nothing for long-term survival.

Most Important SaaS KPIs You Need to Track

1. Total Number of Paid Customers

This one’s simple—but dangerously easy to ignore. It’s the raw count of people actually giving you money for your product in a given period. Not free trial users. Not “maybe next quarter” leads. Actual, paying customers.

Why does it matter? Because this number is the heartbeat of your revenue. If it’s growing, great—you’re selling. If it’s flat or shrinking, something’s broken, whether that’s in your sales process, product, or customer experience.

Track it religiously. When it moves, you’ll know if it’s because your sales tactics worked, your product got better, or your customer service made people stick around.

Total Number of Paid Customers = Number of customers who have purchased a product or service and completed payment within a specific period.

2. Total Number of Sign Ups

This is your front door traffic—the count of new users who’ve raised their hand and said, “I’m in,” over a given period. They might not be paying yet, but they’ve taken the first step.

Sign-ups tell you how well your marketing is working, how appealing your offer looks, and whether your acquisition channels are actually delivering. If this number is weak, you’ve got a visibility or appeal problem. If it’s strong but revenue isn’t moving, you’ve got a conversion problem.

Track it, break it down by source, and watch how changes in campaigns, messaging, or product positioning impact the flow.

Total number of sign-ups = Number of new users registered during the specified period

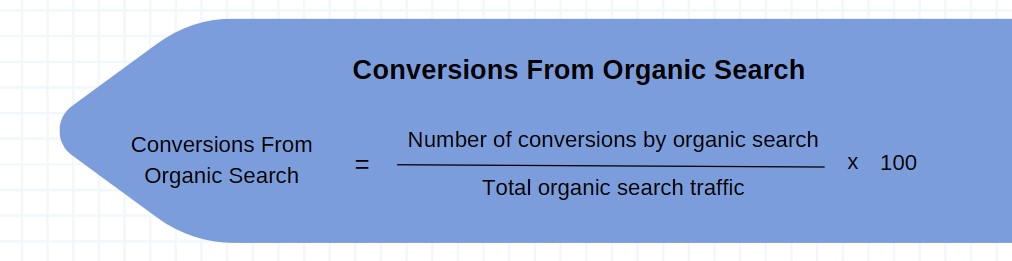

3. Conversions From Organic Search

This is where SEO proves its worth. It’s the number of visitors who didn’t just land on your site from Google—they actually did something valuable: signed up, filled out a form, or swiped their card.

Why care? Because ranking for random keywords is useless if those visitors bounce faster than they arrived. This KPI tells you if your organic traffic is the right traffic—people with intent, not just curiosity.

If the number’s low, it’s a sign your SEO is attracting the wrong crowd or your landing pages aren’t converting. If it’s high, double down—you’ve found a channel that prints money without paying for clicks.

Conversions from Organic Search = (Number of conversions by organic search / Total organic search traffic) x 100

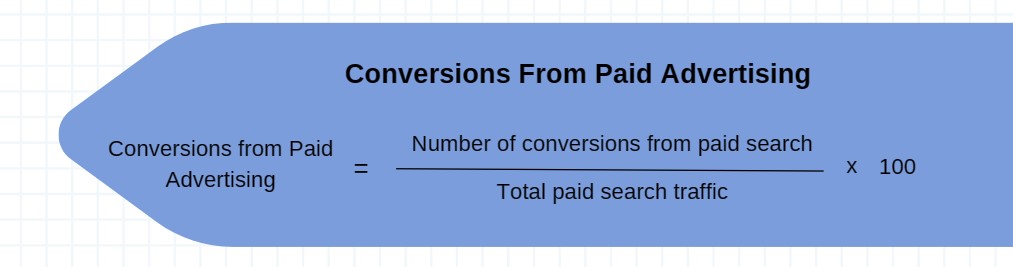

4. Conversions From Paid Advertising

This is your “did the ads actually work?” metric. It counts the actions people take after clicking your ad—buying, signing up, or filling out a form.

It’s the clearest way to see if your paid search budget is pulling its weight. If conversions are high, your targeting and messaging are on point. If they’re low, you’re either aiming at the wrong audience, writing weak ad copy, or sending clicks to a landing page that can’t close.

Track it religiously. Every wasted click is money you’ll never get back.

Conversions from Paid Advertising = (Number of conversions attributed to paid search / Total Paid Search Traffic) x 100

5. Customer Acquisition Cost (CAC)

CAC is the price tag on every new customer you bring in. You calculate it by taking your total sales and marketing spend for a period and dividing it by the number of new customers you got in that same period.

Why does it matter? Because if you’re spending more to get a customer than they’ll ever pay you, you’re digging a hole instead of building a business.

Keeping CAC in check tells you if your marketing is efficient, your sales process is working, and your growth is actually profitable—not just impressive on paper.

CAC = Total Acquisition Expenses / Number of New Customers

6. Customer Retention Rate (CRR)

CRR is your loyalty score. It’s the percentage of customers who stick with you over a given period instead of disappearing into the churn void.

Why it matters: new customers are expensive. Retained customers are profitable. A high retention rate means you’re delivering value, building trust, and giving people zero reason to leave.

If CRR starts slipping, something’s off—maybe your product’s losing its edge, competitors are offering better deals, or your customer experience needs a tune-up. Ignore it, and you’ll spend all your time (and money) replacing the customers you already had.

CRR = [(E – N)/S] x 100,

Where,

E = number of customers at the end of time period.

N = number of customers gained within the time period.

S = number of customers at the start of time period.

For example, you have 150 customers at the start of the month. You gain 30 new customers and lose 10 customers till the end of the month. So, you now have 170 customers at the end of the month.

CRR = [170 – 30 / 150] x 100 = 93.33%

7. Customer Churn Rate

Churn rate is the flip side of retention—it’s the percentage of customers who bail on you in a given period. Monthly, quarterly, yearly… however you track it, it’s the “leaky bucket” number.

A high churn rate is a flashing red light. It means people are leaving because they’re unhappy, not seeing value, or finding a better option elsewhere.

Lowering churn isn’t just nice—it’s survival. Plug the leaks, and every new customer you win actually adds to your growth instead of just replacing the ones who left.

Churn Rate = (No. of customers lost during a period / Total no. of customers at the beginning) x 100

8. Customer Lifetime Value (CLV or LTV)

CLV is the total revenue you can expect from a customer before they churn. It’s shaped by how often they buy, how much they spend, and how long they stick around.

Why it matters: CLV tells you exactly how much you can afford to spend to win—and keep—a customer. If your CLV is high, you can outspend competitors on acquisition. If it’s low, you need to either raise prices, increase retention, or sell more to the same customers.

Get this number wrong, and your growth strategy is just guesswork.

CLV = Average Customer Value x Average Customer Lifespan

9. Monthly Recurring Revenue (MRR)

MRR is the lifeblood of any subscription business—the predictable revenue you bring in every month from paying customers. It includes recurring charges, discounts, and add-ons, but leaves out one-time payments.

Why it matters: MRR shows you how healthy and stable your business really is. If it’s growing steadily, you’re stacking predictable income. If it’s flat or dipping, your growth engine needs work—whether that’s fixing churn, improving upsells, or boosting new sign-ups.

Track it like a hawk. It’s the clearest window into your SaaS growth trajectory.

MRR = Total Number of Subscribers x Average Revenue per Subscriber per month

10. Annual Recurring Revenue (ARR)

ARR is your big-picture subscription number—the total predictable revenue you expect to pull in over a year from paying customers. It’s just your MRR multiplied by 12, with all the one-off sales and variable income stripped out.

Why it matters: ARR shows the scale of your subscription business in the clearest way possible. Investors love it, teams rally around it, and it gives you a north star for long-term growth.

If ARR isn’t moving up and to the right, neither is your company.

ARR = MRR x 12

11. Net Promoter Score (NPS)

NPS is the quick-and-dirty way to measure customer loyalty. You ask one question: “How likely are you to recommend us to a friend or colleague?” They answer on a scale from 0 to 10.

Promoters (9–10) love you. Detractors (0–6) don’t. Subtract the percentage of Detractors from the percentage of Promoters, and you get your NPS.

A high NPS means customers aren’t just satisfied—they’re willing to put their reputation on the line to recommend you. A low one? Time to dig into what’s broken before they start recommending your competitors instead.

NPS = % of Promoters – % of Detractors

12. Customer Satisfaction Score (CSAT)

CSAT measures how happy your customers are—straight from the source. You ask them to rate their experience through surveys, feedback forms, or quick “How did we do?” prompts.

A high score means you’re delivering what they want (and maybe even more). A low score is a neon sign pointing to where you’re dropping the ball.

It’s simple, fast, and brutally honest. If you’re not tracking CSAT, you’re guessing about customer happiness—and in SaaS, guessing is expensive.

To calculate the percentage of satisfied customers,

CSAT = Total no. of customers who are ‘very satisfied’ or ‘satisfied’ / Total no. of responses

Conclusion

Dashboards are useless if you’re tracking the wrong stuff.

The 12 KPIs we just covered aren’t “nice to have” vanity numbers—they’re the levers that actually move your SaaS business forward.

Ignore them, and you’ll spend months chasing growth without realizing your churn is eating you alive, your CAC is out of control, or your MRR is flatlining.

Track them, and you’ll know exactly where to push, what to fix, and when to double down.

Pick a baseline for each KPI today. Review them monthly. And don’t just watch the numbers—act on them. Because the SaaS companies that win aren’t the ones collecting the most data….they’re the ones using it to make the right moves.

Also read about SaaS Metrics – 18 Important Metrics SaaS Companies Should Care About