Off-the-shelf financial software promises simplicity, but in reality, it often forces your business to adapt to its limitations. Workflows don’t quite fit. Integrations feel bolted on. And the moment your needs grow, the cracks start to show.

That’s why custom financial software matters. It’s built around how your business actually runs, automating workflows, delivering real-time insights, and enabling security and integrations that off-the-shelf tools can’t match. In 2026, speed and precision aren’t optional. Fintech evolves fast, regulations faster, and customers expect perfection. Generic software falls behind; custom software keeps you ahead.

This guide breaks down everything you need to know about custom financial software development in 2026: what it is, when it makes sense, how the development process works, costs to expect, must-have features, real-world use cases, and the key trends shaping modern financial systems. No fluff, just practical, decision-ready insights.

What Is Custom Financial Software Development?

Custom financial software development is the practice of building software specifically for your financial workflows, regulatory requirements, and business goals. Instead of forcing your team to adapt to generic tools, the software is designed around how your organization actually operates.

These solutions can power digital banking platforms, payment systems, risk and compliance tools, accounting automation, investment tracking, and internal financial operations. They’re either built from the ground up or heavily customized to meet strict security, performance, and compliance standards.

The real value is focus. Custom financial software exists to solve problems that off-the-shelf products can’t, whether that’s complex integrations, unique data models, advanced automation, or regulatory demands that leave generic software struggling to keep up.

Why Custom Financial Software Matters in 2026

In 2026, financial software is inseparable from security and compliance. Data breaches are more expensive, regulators are stricter, and standards like SOC 2, PCI DSS, and GDPR continue to evolve. Custom financial software lets you design security and compliance into the core of your system, instead of relying on off-the-shelf tools to catch up after new rules take effect.

Custom solutions also deliver a real competitive edge. They allow you to build proprietary features, smarter automation, unique risk models, or tailored customer experiences that generic software can’t replicate. In a crowded fintech landscape, these small but meaningful differences often determine long-term growth.

Just as important, custom financial software scales and integrates cleanly. It adapts as your products, markets, and regulations change, and it connects legacy systems with modern APIs into a single source of truth. The result is less manual work, fewer errors, and systems that support your business instead of slowing it down.

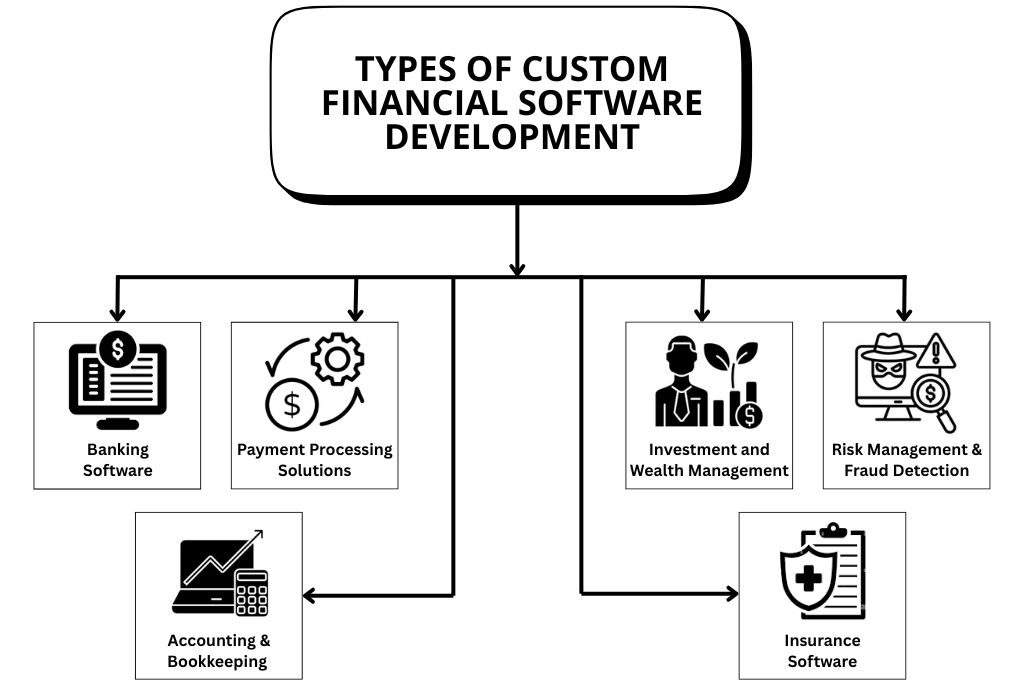

Types of Custom Financial Software

Custom financial software is built to support specific financial operations, customer experiences, and regulatory requirements. In 2026, businesses invest in tailored solutions to gain control, improve efficiency, and scale without the limitations of off-the-shelf tools.

Banking Software

Custom banking software powers digital banks, neobanks, and traditional institutions, modernizing their infrastructure. These systems handle account management, payments, fraud detection, and real-time notifications while meeting strict regulatory requirements. The real advantage is control; custom software lets banks tailor user experiences, security policies, and integrations without being limited by vendor roadmaps.

Payment Processing Solutions

Payment processing software manages how money moves across platforms, currencies, and devices. Custom solutions support card payments, mobile wallets, recurring billing, and cross-border transactions while integrating directly with accounting and ERP systems. In 2026, businesses use custom payment platforms to reduce transaction friction, improve approval rates, and automate settlements and financial reporting.

Accounting and Bookkeeping Automation

Custom accounting software automates repetitive financial tasks that slow teams down. These systems connect bank feeds, process invoices, track expenses, and generate compliance-ready reports aligned with your business structure. Unlike generic tools, custom solutions reflect your workflows and tax requirements, reducing errors while giving finance teams real-time visibility into cash flow and performance.

Investment and Wealth Management Platforms

Investment and wealth management platforms go far beyond basic portfolio tracking. Custom solutions support portfolio analysis, risk modeling, client reporting, and regulatory compliance in one system. In 2026, many platforms also integrate AI-driven insights to support smarter asset allocation, personalized strategies, and data-backed decision-making for advisors and investors alike.

Risk Management and Fraud Detection

Risk management software helps financial organizations detect threats before they become losses. Custom platforms analyze real-time data to flag suspicious behavior, automate compliance checks, and monitor credit, market, and operational risk. Built correctly, these systems adapt to evolving fraud patterns and regulatory demands instead of relying on static, rule-based logic.

Insurance Software

Custom insurance software supports policy management, underwriting, claims processing, and customer communication across digital channels. In 2026, insurers use custom platforms to automate workflows, enable self-service portals, and integrate third-party data for more accurate risk assessment. The result is faster claims, better pricing models, and improved customer experience.

Core Features of Custom Financial Software

Modern financial software is built to move fast, stay compliant, and scale without friction. In 2026, these features aren’t “nice to have”, they’re expected:

- Enterprise-Grade Security: Multi-factor authentication, encryption, role-based access, and continuous security monitoring built in from day one.

- Automated Compliance: Real-time compliance checks that adapt as regulations change, reducing manual work and risk.

- Custom Dashboards & Reporting: Flexible dashboards that surface the KPIs and insights your business actually cares about.

- Seamless API Integrations: Clean integrations with banks, payment gateways, CRMs, ERPs, and internal systems.

- Mobile & Web Access: Secure, responsive access across devices for customers and teams, anywhere.

- Automation & AI: Automated workflows, fraud detection, and AI-driven insights that cut costs and improve decision-making.

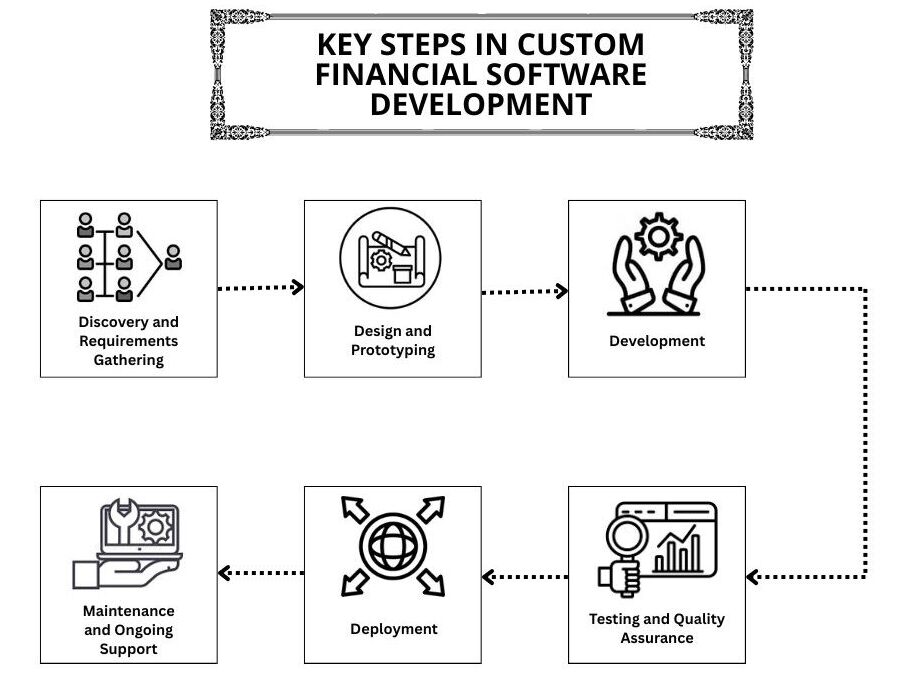

Key Steps in Custom Financial Software Development

Custom financial software succeeds when it follows a clear, risk-aware process. In 2026, teams prioritize alignment, security, and flexibility from day one to avoid costly rework and compliance issues later.

Step 1: Discovery and Requirements Gathering

This phase defines what you’re actually building and why. Stakeholders from business, compliance, IT, and operations align on goals, pain points, regulatory constraints, and success metrics. The output is a clear requirements document that removes guesswork and ensures development starts with shared expectations instead of assumptions.

Step 2: Design and Prototyping

Design turns requirements into something you can see and test. UX flows, wireframes, and clickable prototypes map how users interact with the system. In 2026, this step focuses heavily on usability, accessibility, and efficiency, catching workflow issues early, before they become expensive to fix in code.

Step 3: Development

This is where the system takes shape. Developers build core features, implement security controls, integrate APIs, and structure databases using agile methodologies. Work is delivered in small, testable increments, allowing stakeholders to review progress, give feedback, and adjust priorities without derailing the entire project.

Step 4: Testing and Quality Assurance

Testing ensures the software works as expected and fails safely when it doesn’t. This step includes functional testing, security testing, performance checks, and compliance validation. Automated testing plays a major role in 2026, helping teams catch issues early and maintain reliability as the codebase grows.

Step 5: Deployment

Deployment moves the software into production with minimal risk. This often includes staged rollouts, real-time monitoring, and rollback plans in case something breaks. A smooth deployment isn’t just about going live; it’s about ensuring stability, performance, and user confidence from day one.

Step 6: Maintenance and Ongoing Support

Launch is not the finish line. Ongoing maintenance covers security patches, performance optimization, regulatory updates, and feature improvements. In 2026, financial software must evolve continuously, and a strong support plan ensures your system stays secure, compliant, and aligned with business growth.

Cost of Custom Financial Software Development in 2026

In 2026, custom financial software costs are driven less by “how many screens” and more by security depth, regulatory exposure, and long-term scalability. Budgeting correctly means understanding both build and ownership costs.

- Key Cost Drivers: Project scope, feature complexity, security standards, compliance requirements, third-party integrations, and use of AI or advanced analytics.

- Typical Budgets (2026): Small tools cost $40K–$100K, mid-sized fintech platforms run $150K–$350K, and enterprise banking or investment systems often exceed $600K.

- Ongoing Costs: Maintenance, security patches, compliance updates, cloud infrastructure, and support typically add 15–30% annually.

Benefits of Custom Financial Software

Custom financial software is built for control, efficiency, and long-term growth. In 2026, it’s less about having “custom code” and more about owning systems that actually fit your business.

- Tailored Functionality: Features are designed around your workflows, eliminating workarounds and boosting productivity.

- Stronger Security: You control security architecture and can respond quickly to new threats targeting financial data.

- Better User Experience: Interfaces are built for your users, improving accuracy, adoption, and satisfaction.

- Long-Term Savings: Fewer license fees, less manual work, and reduced vendor dependency lower total cost over time.

Risks and Challenges of Custom Development

Custom financial software delivers control and flexibility, but it’s not without trade-offs. In 2026, understanding these upfront helps teams plan smarter and avoid costly missteps.

- Longer Build Time: Custom development takes longer than off-the-shelf tools, requiring clear timelines and disciplined execution.

- Higher Upfront Costs: Initial investment is higher, though long-term ROI often justifies it for scalable or complex systems.

- Vendor Dependence: The wrong development partner can slow progress, making due diligence critical.

- Ongoing Maintenance: Regular updates, security patches, and support must be planned and budgeted for.

How to Choose a Custom Financial Software Development Partner

Choosing the right development partner is often more important than the technology itself. Financial software projects succeed when vendors combine domain knowledge, security discipline, and long-term accountability, not just coding skills in 2026:

Industry Experience

A strong partner brings proven experience in fintech or financial services. They understand regulatory pressure, audit requirements, and data sensitivity, which reduces costly mistakes. Look for vendors with relevant case studies, repeat financial clients, and experience building systems that have passed real-world compliance and security reviews.

Security Expertise

Security can’t be an afterthought in financial software. Your partner should follow secure-by-design practices, including encryption, threat modeling, vulnerability testing, and regular security audits. In 2026, vendors must demonstrate how they proactively handle emerging threats, not just react after something goes wrong.

Technical Capabilities

Technical depth matters when systems become complex. Evaluate the partner’s experience with modern tech stacks, API-first architectures, cloud infrastructure, and large-scale integrations. Case studies and references help validate their ability to build reliable, scalable systems that integrate cleanly with your existing platforms.

Communication and Project Management

Clear communication keeps projects moving. A reliable partner uses structured project management, agile sprints, and regular progress updates to avoid surprises. Dedicated project managers and transparent timelines ensure alignment across business, technical, and compliance teams throughout the development lifecycle.

Post-Launch Support

Launch is only the beginning. The right partner provides ongoing maintenance, security updates, and clear SLAs for bug fixes and enhancements. In 2026, long-term support is essential to handle regulatory changes, performance tuning, and feature evolution as your business grows.

Emerging Trends in Custom Financial Software Development for 2026

Financial software in 2026 is shaped by smarter automation, tighter data sharing, and higher user expectations. These trends are already defining how competitive financial platforms are built.

- AI and Machine Learning: Used for fraud detection, risk modeling, predictive analytics, and intelligent automation with measurable ROI.

- Blockchain Beyond Crypto: Powering smart contracts, audit trails, and secure transaction transparency in payments and compliance.

- Open Banking APIs: Enabling secure data sharing, faster integrations, and new financial products through connected ecosystems.

- Cloud-Native Architecture: Built for scalability, resilience, and global availability from day one.

- UX-First Design: Financial apps now match consumer-grade experiences, driving adoption and retention.

Real-World Examples of Custom Financial Software

In 2026, custom financial software powers many of the fastest-growing and most reliable financial products. These real-world examples show how tailored platforms outperform generic tools in speed, flexibility, and user experience.

Digital-Only Banking Apps

Many digital-only banks run entirely on custom-built platforms designed around mobile-first users. These apps support instant account creation, real-time transaction insights, and advanced security controls. By owning the full tech stack, banks can iterate faster, personalize features, and adapt quickly to regulatory and customer demands.

Automated Loan Origination Systems

Custom loan origination software streamlines the entire lending lifecycle. These systems integrate credit scoring, document uploads, identity checks, and e-signatures into a single workflow. The result is faster approvals, fewer manual errors, improved compliance, and a smoother experience for both lenders and borrowers.

Investment Robo-Advisors

Robo-advisors rely on custom algorithms to automate portfolio allocation, rebalancing, and performance tracking. Modern platforms also offer personalized dashboards, tax optimization, and compliance-ready reporting. In 2026, custom robo-advisors combine automation with transparency, helping firms scale advisory services without sacrificing control or trust.

Insurtech Claims Automation

Insurance providers use custom claims platforms to automate submissions, validation, and payouts. AI-driven checks flag potential fraud, while real-time status updates improve communication with policyholders. These systems reduce processing times, cut operational costs, and deliver faster, more predictable claims experiences.

How to Get Started With Custom Financial Software Development

Getting started is less about writing code and more about making the right decisions early. In 2026, successful financial software projects begin with clarity, realistic planning, and early alignment across business, technical, and compliance teams.

Define Your Goals and Requirements

Start by clearly documenting what the software must achieve. This includes business objectives, user workflows, reporting needs, and regulatory requirements. A well-defined requirements document removes ambiguity, aligns stakeholders, and gives development teams a clear target, reducing rework, delays, and budget overruns later.

Set a Realistic Budget and Timeline

Work with your development partner to estimate costs, resources, and delivery milestones. A realistic roadmap accounts for design, development, testing, feedback cycles, and regulatory reviews. In 2026, flexible timelines matter, and building in buffer time helps teams adapt to changes without sacrificing quality or compliance.

Choose the Right Development Partner

Your development partner directly impacts project success. Look for proven financial domain experience, strong technical capabilities, and clear communication practices. Reviewing case studies, speaking with past clients, and assessing cultural fit help ensure the partner understands both your technology needs and regulatory environment.

Plan for Compliance and Security

Compliance and security must be embedded from the start, not added later. Involve legal, compliance, and IT teams to identify applicable regulations like PCI DSS or GDPR. Early planning ensures security controls, audit readiness, and data protection are built into the system architecture.

Map Out Integration Points

List every system your software needs to connect with, from payment gateways and bank feeds to ERPs and CRMs. Planning integrations early prevents bottlenecks, data silos, and expensive redesigns later. Clean, well-documented APIs make long-term maintenance and scaling far easier.

Involve Stakeholders Early

Bring end users, compliance teams, and business leaders into the process early. Their feedback during design and prototyping helps surface real-world needs and usability issues. Early involvement reduces late-stage changes and ensures the final product delivers practical value across the organization.

Is Custom Financial Software the Right Move?

Custom financial software is the right choice when your business no longer fits into generic tools. If you rely on complex workflows, strict compliance, or proprietary logic, off-the-shelf software quickly becomes a bottleneck rather than a solution.

Yes, custom development requires more upfront investment and planning. But in return, you gain full control over security, integrations, and scalability without waiting on a vendor’s roadmap or paying for features you don’t need. Over time, this flexibility often translates into lower operational costs and stronger differentiation.

In 2026, fintech success is about sustained execution, not one-time innovation. Custom financial software gives you the agility to adapt, the confidence to scale, and the foundation to compete long-term. With clear goals and the right development partner, you’re not just building software, you’re building leverage.